Unlike property or income taxes, Inheritance Tax in New Jersey focuses on who inherits, not on the estate itself. When beneficiaries receive assets, New Jersey classifies them into specific categories to determine tax liability, filing obligations, and payment requirements. This is why many people actively search for whether New Jersey has an inheritance tax—because understanding how the tax works is essential before calculating, filing, or distributing inherited assets under the state’s death tax framework.

Is Inheritance Tax in New Jersey Still Applicable in 2026?

Yes, Inheritance Tax New Jersey is still fully applicable in 2026 despite the repeal of the estate tax.

New Jersey eliminated its estate tax, but New Jersey inheritance tax laws remain unchanged. This creates confusion among heirs who assume that all death-related taxes have been removed and therefore delay reviewing obligations or filing required forms. In reality, inheritance tax still applies to many beneficiaries, making it essential to confirm tax status, calculate potential liability, and plan compliance early—especially for non-immediate family members.

Inheritance Tax New Jersey vs Estate Tax: Why People Confuse the Two

Beneficiaries pay inheritance tax, while the estate pays estate tax before distribution.

People often group both under the term New Jersey death tax, but legally, they are distinct.

Estate tax no longer exists in New Jersey, while inheritance tax does and must still be evaluated, calculated, and filed when applicable.

Understanding this distinction is critical when reviewing New Jersey estate and inheritance tax rates, estimating costs, and making informed estate planning or beneficiary decisions.

Who has to pay inheritance tax in New Jersey?

Only particular beneficiaries are required to pay the Inheritance Tax in New Jersey, depending on their relationship to the deceased.

Yes, spouses, children, and qualifying stepchildren are exempt from inheritance tax. This exemption applies regardless of asset value, meaning these beneficiaries generally do not need to calculate tax, submit payments, or worry about rate thresholds, including filing an Inheritance Tax return in New Jersey. Because this rule is often misunderstood when discussing the death tax in New Jersey, clearly confirming exemption status can help families avoid unnecessary filings and compliance errors.

Are Spouses, Children, and Stepchildren Exempt?

Yes, spouses, children, and qualifying stepchildren are exempt from inheritance tax. This exemption applies regardless of asset value, meaning these beneficiaries generally do not need to calculate tax, submit payments, or worry about rate thresholds. Because this rule is often misunderstood when discussing the New Jersey death tax, clearly confirming exemption status can help families avoid unnecessary filings and compliance errors.

How New Jersey Treats Siblings, Nieces, Friends, and Non-Relatives

New Jersey imposes higher tax rates on siblings, extended relatives, and unrelated beneficiaries. Siblings fall into Class C, while friends and non-relatives fall into Class D. These beneficiaries often face unexpected tax obligations, making it essential to calculate liability early, prepare required documentation, and plan payment timing. As a result, tools like an Inheritance Tax calculator New Jersey are commonly used before filing to avoid surprises and penalties.

Does the Tax Apply to Out-of-State or Non-Resident Heirs?

Yes, inheritance tax can apply even if the beneficiary lives outside New Jersey. The determining factor is the decedent’s connection to New Jersey, not the heir’s residency. Many non-resident beneficiaries are surprised to learn they must still file an Inheritance Tax return in New Jersey, submit supporting documents, and resolve tax obligations for assets sourced from the state before distributions are released.

What Assets Are Subject to Taxation?

Taxation applies to most transferred assets unless a specific exemption applies. Common taxable assets include real estate, financial accounts, and business interests. Because asset treatment varies, beneficiaries often review asset types carefully and use a New Jersey inheritance tax calculator to estimate taxable value, confirm exemptions, and prepare accurate filings before distribution.

Rates and Exemptions Explained Simply

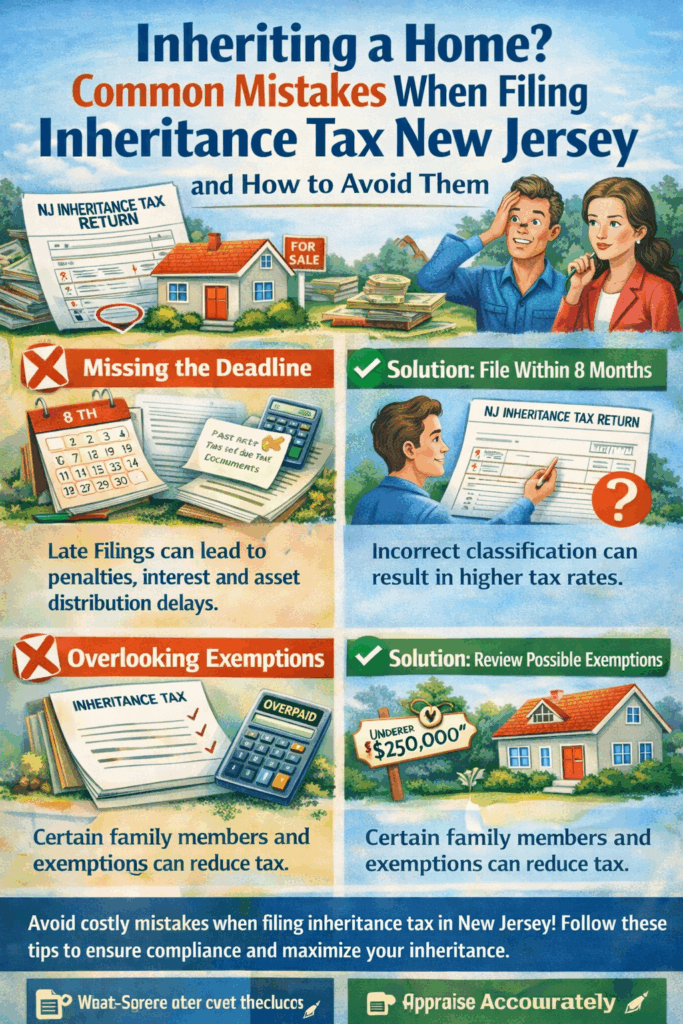

Tax rates vary by beneficiary class and the value of the inheritance. There is no single flat rate. Instead, New Jersey estate and inheritance tax rates are applied progressively depending on the beneficiary’s classification. Understanding applicable exemptions and thresholds helps beneficiaries calculate liability correctly, avoid overpayment, and ensure accurate filing before submitting returns.

How Much Will You Owe? (Calculation Examples)

The amount owed depends on the relationship, the asset type, and the total value. For example, a child inheriting $300,000 pays no tax, while a sibling inheriting the exact amount may owe tax. Because outcomes vary widely, many beneficiaries rely on an Inheritance Tax calculator in New Jersey to estimate amounts, plan payments, and file with confidence.

Filing Deadlines, Forms, and Requirements

An Inheritance Tax return in New Jersey is generally due within eight months of the decedent’s death. Late filings may result in interest or penalties. Executors often prepare and submit the New Jersey Inheritance Tax return early, delaying distributions until acceptance to ensure compliance, avoid fines, and release assets without legal complications.

What Happens If You File Incorrectly or Late?

Filing incorrectly or late can lead to penalties, interest, and delays in asset processing. Errors may trigger audits, require amended filings, or prevent property transfers. This is why many beneficiaries choose to carefully review calculations, verify classifications, and seek professional guidance when managing New Jersey inheritance tax obligations.

Inheriting a Home? How Real Estate is Affected

Inheritance tax can delay or complicate the transfer of inherited real estate. Tax clearance may be required before sale or transfer. After inheritance, some heirs explore property tax relief programs in New Jersey to reduce ongoing ownership costs, particularly if they plan to occupy the home, even though such relief does not offset the inheritance tax itself.

Legal Ways to Reduce or Plan for the Tax

Strategic planning can legally reduce tax exposure for future heirs. Common approaches include beneficiary structuring, lifetime gifting, and trust planning. While Inheritance Tax in New Jersey cannot always be avoided, proactive planning allows families to minimise liability, streamline filings, and protect asset value over time.

FAQ

Does New Jersey have an inheritance tax?

Yes, New Jersey does have an inheritance tax, and it is still in effect in 2025.

Although New Jersey repealed its estate and inheritance taxes, it continues to apply to particular beneficiaries based on their relationship to the deceased.

Who has to pay inheritance tax in New Jersey?

Only particular beneficiaries are required to pay inheritance tax in New Jersey, mainly siblings, extended relatives, and unrelated individuals.

Spouses, children, parents, and qualifying stepchildren are exempt, while others may owe tax depending on beneficiary class and inheritance value.

How much is inheritance tax in New Jersey?

Inheritance tax rates in New Jersey vary by beneficiary class and the amount inherited, with higher rates applying to more distant relationships.

There is no single flat rate—tax liability depends on New Jersey estate and inheritance tax rates, exemptions, and thresholds.

How do you calculate inheritance tax in New Jersey?

Inheritance tax in New Jersey is calculated by applying beneficiary class rules and tax rates to the taxable value of inherited assets.

Many beneficiaries use a New Jersey inheritance tax calculator or an Inheritance Tax calculator New Jersey to estimate liability before filing.

What is the deadline to file an inheritance tax return in New Jersey?

An Inheritance Tax return in New Jersey is generally due within eight months of the decedent’s death.

Late filing may result in interest, penalties, or delays in the distribution of inherited assets.

Does New Jersey inheritance tax apply to inherited real estate?

Before selling or transferring property, tax clearance may be required, and some heirs later explore property tax relief options in New Jersey to reduce ongoing ownership costs.