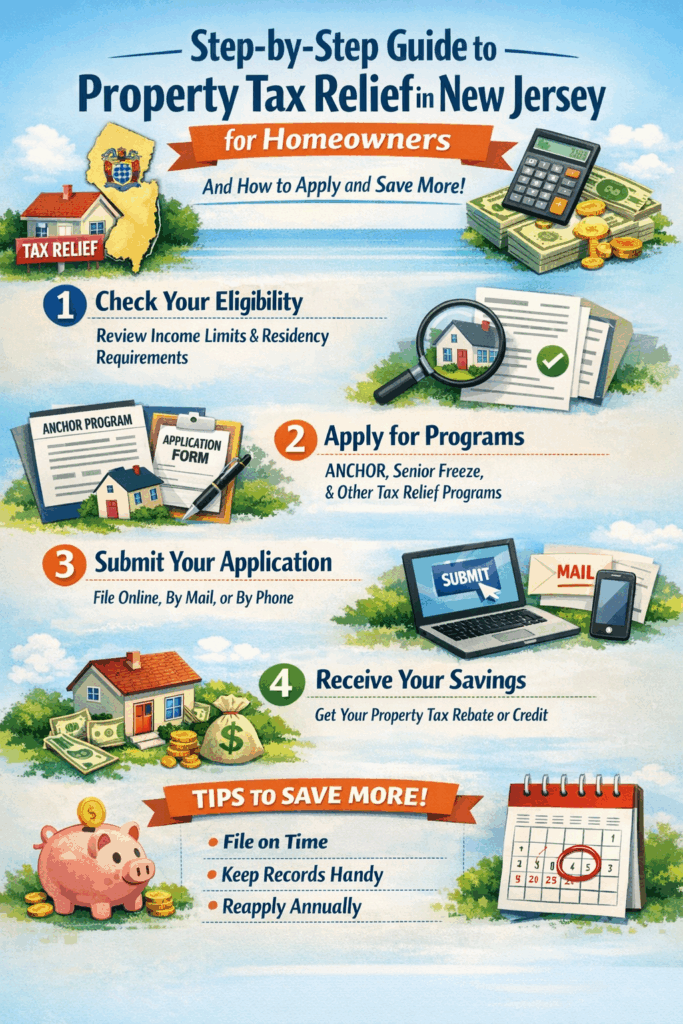

It can be tough to figure out how property tax exemptions function in New Jersey, particularly if you are a homeowner and don’t know what your taxes are. I will address all the property tax exemptions available in New Jersey. Under those circumstances, they apply, and how they help individuals save on property tax relief in New Jersey.

Start saving today! To learn more, read the entire article to see if you qualify for New Jersey Property Tax Relief programs and how they can lower your taxes. Maximize your savings! Find out how you can apply for a property tax exemption, and don’t miss any of the savings.

What Is NJ Property Tax Relief and How Does It Work?

Property Tax Relief in New Jersey is a set of programs that provide individuals with property tax relief. Programs like these can provide relief from the tax burden — particularly for seniors, low-income families, and individuals with disabilities.

Some of the property tax relief programs available in New Jersey include Senior Freeze, Stay NJ, and Anchor. The anchor benefit of New Jersey is a program that helps New Jersey taxpayers who have difficulty affording the state’s sky-high property tax bills.

Relief types in New Jersey

Property tax relief

Payment/maximum benefit*

Description

Rebate

$1,000

Checks issued to eligible homeowners (age 65 or older) and tenants (age 18 or older)

Renters’ rebate

$245

Don’t miss out on valuable property tax relief! If you’re a New Jersey resident who has filed your income tax return, you could automatically qualify for checks based on your income. With property taxes in New Jersey among the highest in the country, these relief programs are a crucial lifeline for seniors and others on fixed incomes. Act now to ease your financial burden—apply for your relief today and start saving!

Who Is Eligible for Property Tax Relief in New Jersey?

Property Tax Relief in New Jersey. In New Jersey, eligible applicants must meet specific criteria regarding age, income, and residency status to qualify for property tax relief. Seniors, people with disabilities, and low-income renters or homeowners are generally allowed.

Senior citizens (age 65+) and people with disabilities may be eligible for programs such as Senior Freeze or Stay NJ.

Income limits differ by program; however, in the case of Senior Freeze, there is a strict income cut-off.

Both homeowners and renters can apply for specific programs, such as ANCHOR.

Eligibility Checklist:

You have to be a resident of New Jersey.

There are limits on income and property taxes.

Some programs have other requirements, such as age or disability.

Why It Matters: These initiatives are designed to reduce the tax burden on society’s most vulnerable citizens and prevent them from being taxed out of their homes.

What Is ANCHOR in New Jersey Property Tax Relief?

The ANCHOR (Affordable New Jersey Communities for Homeowners and Renters) program implements Property Tax Relief in New Jersey to homeowners and renters. It also issues rebates based on residents’ income in credit areas.

ANCHOR aimed to offer direct financial assistance for middle-class homeowners and renters.

It provides rebates to qualifying homeowners and renters — and the amount is based on income.

It’s an effort to make housing more affordable for its residents, who pay some of the highest property taxes in America — and are just one PATH stop away from Jersey City.

Key Features of anchor :

Available to homeowners and renters who meet income requirements.

Rebates are paid directly to the applicant.

Why It Matters: ANCHOR aims to lighten this burden for New Jersey residents by reducing property taxes, particularly for lower-income households in places such as Jersey City.

What Is the Property Tax Reimbursement (Senior Freeze) Program?

The Senior Freeze program gives eligible senior citizens and disabled persons a check for any property tax increases, essentially “freezing” their property taxes at that level.

The Senior Freeze program currently benefits seniors and disabled residents who meet the qualifications by reimbursing them for surges in property taxes over a specific period.

To be eligible, you must meet income guidelines, be 65 or older, and have lived in New Jersey for at least 10 years.

Eligibility Requirements:

Be 65 years of age or older, or be disabled.

Have made New Jersey their home for at least 10 years.

Meet income thresholds.

Why It Matters: It offers seniors and people with disabilities peace of mind by preventing New Jersey from imposing massive, unpredictable property tax hikes.

What Is the Stay NJ Program and How Does It Function?

The Stay NJ program aims to assist low- and moderate-income homeowners in New Jersey through financial assistance to pay property taxes.

The Stay NJ program provides financial support to homeowners who are struggling to pay their property taxes in New Jersey.

The program is open to residents who meet certain income thresholds and other criteria.

Eligibility Requirements:

Homeowners must have experienced a property tax delinquency.

A specific income limit is in place to ensure it is targeted at low- and moderate-income families.

Why It Matters: Stay NJ protects residents who, due to financial hardship, are having difficulty paying their property taxes from losing their homes.

What Are the Income Cap Property Tax Relief Benefits in New Jersey?

The income limits work differently depending on the Property Tax Relief in New Jersey program. Generally, the range is between $40,000 and $100,000 per year, and it varies based on your filing status for that income.

Senior property tax relief programs like Senior Freeze have more stringent income limits — anchor has looser rules and higher caps.

Applicants must fall within the current income limits to be eligible, which are updated periodically.

Income Requirements by Program:

Senior Freeze: Approximately $90,000 for single filers.

ANCHOR: Income dependent, with separate limits for homeowners and renters.

Why It Matters: Guarantees that relief for property taxes goes to people who actually need it and shields the system from misuse.

Do Renters Qualify for Property Tax Relief in New Jersey?

Yes, renters in New Jersey can get property tax relief through programs such as ANCHOR, which provide income-based rebates.

Renters in New Jersey can qualify for Property Tax Relief in New Jersey through the anchor program if they make less than a certain amount of money.

Renters don’t pay property taxes directly; landlords pass the burden on to tenants in rent. The discount undercuts that expense.

Why It Matters: New Jersey renters are regularly smothered by high rent increases, driven in part by rising property tax rates. This relief is one reason renters are not as overwhelmed by high housing costs.

Conclusion:

Securing property tax relief for seniors in NJ is a vital strategy for long-term financial stability, especially as new legislation like the Stay NJ program rolls out in 2026. By making use of available programs—including the Senior Freeze and the expanded ANCHOR benefit—and understanding the application steps, you can significantly reduce your tax burden. For many, finding reliable property tax relief in NJ means staying in their homes and closer to family.

Leveraging these opportunities for property tax relief for seniors in NJ ensures you aren’t overpaying into a complex system. Taking the time to apply today is a simple yet powerful way to secure your financial freedom and protect your home for the years to come.

1) What is New Jersey Property Tax Relief?

New Jersey Property Tax Relief is a group of state programs that help eligible residents lower property tax costs through rebates or reimbursements.

2) Who qualifies for property tax relief in New Jersey?

Most programs are for NJ residents who meet certain income limits, and some require being 65+, disabled, or a qualifying renter/homeowner.

3) What is the ANCHOR program in New Jersey?

ANCHOR gives income-based rebates to eligible homeowners and renters to offset New Jersey’s high property taxes and housing costs.

4) How does the Senior Freeze (Property Tax Reimbursement) work?

Senior Freeze reimburses eligible seniors/disabled residents for property tax increases, helping keep taxes closer to a stable “base-year” level.

5) Can renters get property tax relief in New Jersey?

Yes—renters can qualify (often through ANCHOR) because property taxes are indirectly built into rent, and rebates help reduce that burden.